Notes from Your Bettendorf Financial Group Team

Pullbacks, Corrections, and Bear Markets

When the market drops, some investors lose perspective that downtrends and uptrends are part of the investing cycle. When stock prices break lower, it’s a good time to review common terms that are used to describe the market’s downward momentum.

Pullbacks

A pullback represents the mildest form of a selloff in the markets. You might hear an investor or trader refer to a dip of 5-10% after a peak as a “pullback.”

Corrections

The next degree in severity is a “correction.” If a market or markets retreat 10% to 20% after a peak, you’re in correction territory. At this point, you’re likely on guard for the next tier.

Bear Market

In a bear market, the decline is 20% or more since the last peak.

All of this is normal

“Pullbacks, corrections, and bear markets are a part of the investing cycle.”

When stock prices are trending lower, some investors can second-guess their risk tolerance. But periods of market volatility can be the worst times to consider portfolio decisions.

Pullbacks and corrections are relatively common and represent something that any investor may see from time to time in their financial life, often several times over the course of a decade. Bear markets are much rarer. In fact, between April 1947 and September 2021, there have only been 14 bear markets.

A retirement strategy formed with a financial professional has market volatility factored in. As you continue your relationship with that professional, they will also be at your side to make any adjustments and help you make any necessary decisions along the way. Their goal is to help you pursue your goals.

- Investopedia.com, August 23, 2021

- Forbes.com, September 20, 2021

- Investopedia.com, October 29, 2021

A Decision Not Made Is Still a Decision

Whether through inertia or trepidation, investors who put off important investment decisions might consider the admonition offered by motivational speaker Brian Tracy, “Almost any decision is better than no decision at all.”

This investment inaction is played out in many ways, often silently, invisibly and with potential consequence to an individual’s future financial security.

Let’s review some of the forms this takes.

Your 401K Plan

The worst indecision may be the failure to enroll. Not only do nonparticipants sacrifice one of the best ways to save for their eventual retirement, but they also forfeit the money that any employer matching contributions represents. Not participating holds the potential to be one of the most costly indecisions one can make.

The other way individuals let indecision get the best of them is by not selecting the investments for the contributions they make to the 401(k) plan. When a participant fails to make an investment selection, the plan may have provisions for automatically investing that money. And that investment selection may not be consistent with the individual’s time horizon, risk tolerance, and goals.

Under the SECURE Act, in most circumstances, you must begin taking required minimum distributions from your 401(k) or other defined contribution plan in the year you turn 72. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income, and if taken before age 59½, may be subject to a 10 percent federal income tax penalty.

Non-Retirement Plan Investments

For homeowners, “stuff” just seems to accumulate over time. The same may be true for investors. Some buy investments based on articles they have read or based on the recommendations of a family member. Others may have investments held in a previous employer’s 401(k) plan.

Over time, we can end up with a collection of investments that may have no connection to our investment objectives. Because of the dynamics of the markets, an investment that may have once made good sense at one time may no longer be advantageous today.

By not periodically reviewing what we own, which would allow us to cull inappropriate investments – or even determining if the portfolio reflects our current investment objectives – we are making a default decision to own investments that may be inappropriate.

Whatever your situation, your retirement investments require careful attention and may benefit from deliberate, thoughtful decision-making. Your retired self will be grateful that you invested the time … today.

- Brainy Quote, 2021

When Should You Take Social Security

The Social Security program allows you to start receiving benefits as soon as you reach age 62. The question is, should you?

Monthly payments differ substantially depending on when you start receiving benefits. The longer you wait (up to age 70), the larger each monthly check will be. The sooner you start receiving benefits, the smaller the check.

From the Social Security Administration’s point of view, it’s simple: if a person lives to the average life expectancy, the person will eventually receive roughly the same amount in lifetime benefits, no matter when they choose to start receiving them. In actual practice, it’s not quite that straightforward, but the principle holds.

The key phrase is “if the person lives to average life expectancy.” If a person exceeds the average life expectancy and has opted to wait to receive benefits, they will start to accumulate more from Social Security.

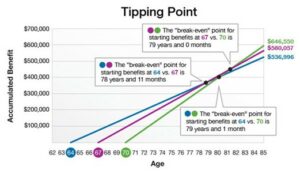

The chart shows how Social Security benefits accumulate for individuals who started to receive at ages 62, 66, and 70. The person who started to receive benefits at age 62 would accumulate $652,320 by the age of 85. Conversely, the person who started to receive benefits at age 70 would accumulate $727,680 by the age of 85. The example assumes the maximum retirement benefit of $3,011 at age 66. It does not assume COLA.

Source: Social Security Administration, 2020

There is no single “right” answer to the question of when to start benefits. Many base their decision on family considerations, economic circumstances, and personal preferences.

If you have a spouse, the decision about when to start benefits gets more complicated – particularly if one person’s earnings were considerably higher than the other’s. The timing of spousal benefits should be factored into a decision.

When considering at what age to start Social Security benefits, it may be a good idea to review all the assets you have gathered for retirement. Some may want the money sooner based on how assets are positioned, while others may benefit by waiting. So, as you near a decision point, it may be best to consider all your options before moving forward.

Social Security: The Elephant in the Room

For most Americans, Social Security has represented nothing more than some unavoidable payroll deduction with the positively cryptic initials of “FICA” and “OASDI” (Federal Insurance Contributions Act and Old Age, Survivors and Disability Insurance). It hinted at a future that seemed both intangible and far away.

Yet, many Americans now sit on the cusp of drawing on the promise that was made with those payments.

As the growing wave of citizens approach retirement, questions and concerns abound. Is Social Security financially healthy? How much will my income benefit be? How do I maximize my benefits for my spouse and myself? When should I begin taking Social Security?

Questions & Elephants

Answering these questions may help you derive the most from your Social Security benefit and potentially enhance your financial security in retirement. Before you can answer these questions, you have to acknowledge the elephant in the room.

The Social Security system has undergone periodic scares over the years that have inevitably led many people to wonder if Social Security will remain financially sound enough to pay the benefits they are owed.

Reasonable Concern

Social Security was created in 1935 during Franklin D. Roosevelt’s first term. It was designed to provide income to older Americans who had little to no means of support. The country was mired in an economic downturn and the need for such support was acute.1

Since its creation, there have been three basic developments that have led to the financial challenges Social Security faces today.

- The number of workers paying into the system (which supports current benefit payments) has fallen from just over 8 workers for every retiree in 1955 to 3.3 in 2005. That ratio is expected to fall to 2.2 to 1 by 2037.

- A program that began as a dedicated retirement benefit later morphed into income support for disabled workers and surviving family members. These added obligations were not always matched with the necessary payroll deduction levels to financially support these additional objectives.

- Retirees are living longer. As might be expected, the march of medical technology and our understanding of healthy behaviors have led to a longer retirement span, potentially placing a greater strain on resources.

Beginning in 2010, tax and other non-interest income no longer fully covered the program’s cost. According to the Social Security Trustees 2020 annual report, this pattern is expected to continue for the next 75 years; the report projects that the trust fund may be exhausted by 2035, absent any changes.4

Social Security’s financial crisis is real, but the prospect of its failure seems remote. There are a number of ways to stabilize the Social Security system, including, but not limited to:

- Increase Payroll Taxes: An increase in payroll taxes, depending on the size, could add years of life to the trust fund.

- Raise the Retirement Age: This has already been done in past reforms and would save money by paying benefits to future recipients at a later age.

- Tax Benefits of Higher Earners: By taxing Social Security income for retirees in higher tax brackets, the tax revenue could be used to lengthen the life of the trust fund.

- Modify Inflation Adjustments: Rather than raise benefits in line with the Consumer Price Index (CPI), policymakers might elect to tie future benefit increases to the “chained CPI,” which assumes that individuals move to cheaper alternatives in the face of rising costs. Using the “chained CPI” may make cost of living adjustments less expensive.

Reform is expected to be difficult since it may involve tough choices—something from which many policymakers often retreat. However, history has shown that political leaders tend to act when the consequences of inaction exceed those taking action.

- Social Security Administration, 2022

- Social Security Administration, 2020

- Social Security Administration, 2022

- Social Security Administration, 2021

Ways to Supplement Your Medicare Coverage

There are a number of ways to fill gaps in your Medicare coverage and/or to get assistance with Medicare costs:

- Job-based insurance:If you or your spouse is still working, and you have insurance through that job, it may work with Medicare to cover your health care costs. You should find out whether your employer insurance is primary or secondary to Medicare. Primary insurance is health insurance that pays first on a claim for care. Secondary insurance pays after primary insurance—but may not pay at all in the absence of primary insurance.

- Retiree insurance:Some employers provide health insurance to retirees and their spouses to fill in the gaps of Medicare coverage. Retiree insurance always pays secondary to Medicare.

- Veterans Affairs (VA) benefits:If you are a veteran and qualify for VA benefits, health care and prescription drugs that you get through the VA may be the cheapest. The VA may also cover services that Medicare will not cover for you. VA benefits do not work with Medicare, and if you receive care outside of a VA facility you might need Medicare. Medicare does not pay for any care at a VA facility.

- Supplemental insurance (Medigap): A Medigap policy provides insurance through a private insurance company and helps fill the cost-sharing gaps in Original Medicare, for instance by helping pay for Medicare deductibles, coinsurances, and copayments. Depending on where you live, you have up to 10 different Medigap plans to choose from: A, B, C, D, F, G, K, L, M, and N. (Note that plans in Wisconsin, Massachusetts, and Minnesota have different names.) Each type of Medigap offers a different set of benefits. Premiums vary, depending on the plan you choose and the company you buy it from.

- Stand-alone Medicare private drug plan (Part D):If you have Original Medicare and want Medicare drug coverage, you need to sign up for a private drug plan (PDP). All Medicare drug plans have different costs and a different list of drugs that they cover (known as the formulary). Make sure the plan you choose covers the drugs you need at a cost you can afford. Also know that if you do not sign up for a Part D plan when you first become eligible, you may incur a premium penalty later on.

- Medicare Advantage Plan: These plans contract with the federal government to provide Medicare benefits. They must provide at least the same set of benefits offered by Original Medicare, but may have different rules, costs, and restrictions. For instance, Medicare Advantage Plans may require that you see health care providers in their network, and/or that you get a referral from your doctor before seeing specialists. Some private health plans offer extra, Medicare-excluded benefits, such as vision or dental care. While premiums may be low, service costs may be higher than in Original Medicare for certain services (or vice-versa). You also may pay more for your care if you do not follow the plan rules. Medicare Advantage Plans must have annual limits on out-of-pocket costs. Although these limits are usually high, they should protect you from excessive costs if you need a lot of health care. Benefit packages may change every year, so it is important to review your current coverage and options annually.

There are also several programs for beneficiaries with limited incomes.

© 2022 Medicare Rights Center. Used with permission.

Comics, Collectibles, and Coping with Calamity

Rare collectibles can provide an entertaining form of alternative “investment,” and might seem particularly intriguing when markets are wobblier than Aunt Gertrude’s jello salad. Comic books can sell for millions of dollars, for example, depending on their rarity and condition. Just this week, a copy of Detective Comics #27 (the first appearance of Batman, recently returned to cinemas) is listed with bids at $1 million.

While you may not be into comic books, items like artwork, antiques, or baseball cards, can hold surprising monetary value, but collectibles can be affected by a number of factors, including liquidity. Here are some sensible steps to take with such items, if you have them.

- Educate Yourself

- Books and price guides are a good place to start, as well as a good old-fashioned Google search.

- Ensure Insurance

- A professional appraisal can help ensure your item’s value is protected in cases of calamity or theft.

- Consult Experts

- Values can change depending on condition and scarcity. Shop owners and other collectors can provide context.

- Protect Valuables

- Some types of items may require special storage or materials to preserve their condition.

Whether you’re looking to sell or hold onto your valuable items, the point is to have fun and enjoy what you have. They say you can’t take it with you, but if you do find a way, we’re certainly all ears.

Don’t Go it Alone

When markets cycle lower like they have been lately, perspective is critical. If you’re not connected to someone with experience, it can be easy to miss the big picture.

If you zoom out a bit in history, most investors haven’t lived through a prolonged price drawdown. For example, a bond fund manager would need to be around 80 years old today to have been working during the inflation of the 1970s (the last time we saw similar movements to what we’re seeing today). We are certainly living through unusual times.

But price swings aren’t surprising to those who are prepared, and you don’t have to figure things out on your own.

When we created your portfolio, we looked at your unique goals, time horizon, and risk profile. Our team has managed several market cycles, and we’ve seen plenty of ups and downs across the investing process.

Please reach out if today’s markets have you feeling uncertain. You don’t have to go it alone: we are here to help you keep things in perspective.